Highlights

- Trump’s new bill faces GOP backlash and diaspora concerns.

- 3.5% tax on remittances worries Indian community in the U.S.

- Financial advisors suggest strategies to mitigate tax impacts.

A political storm is brewing in Washington over former President Donald Trump’s sweeping new economic proposal—the “One Big Beautiful Bill Act” (OBBBA)—with sharp criticism from within his own party and deep concerns among India’s diaspora over a controversial new 3.5% tax on remittances.

Billionaire entrepreneur Elon Musk, a former adviser to the Trump administration’s Department of Government Efficiency, called the 1,038-page bill an “abomination” in a scathing social media post. “This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination,” Musk wrote. “Shame on those who voted for it: you know you did wrong. You know it.”

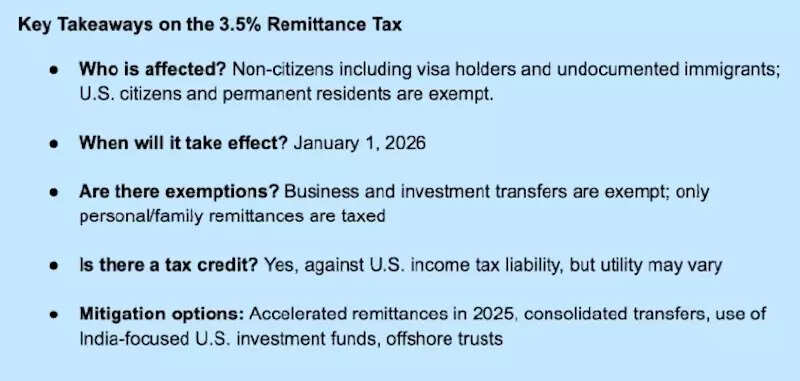

The bill, which combines tax cuts, entitlement reforms, and a range of fiscal proposals under the fast-track budget reconciliation process, also introduces a 3.5% excise tax on outbound personal remittances by non-citizens, including undocumented immigrants. This has triggered alarm in countries like India, the world’s top recipient of remittances.

A Targeted Tax With Broader Implications

Though the tax is framed to affect undocumented individuals, its potential fallout is being felt among the broader Indian-origin community in the U.S., particularly those on temporary work visas (like H-1B and L-1), and green card holders. These groups are significant contributors to the nearly $120 billion that India receives annually in remittances—of which a large portion originates from the United States.

Legal experts point out that the bill’s revised tax rate, reduced from the originally proposed 5% to 3.5%, will still result in considerable financial outgo for those regularly sending money to support families, pay tuition, or service mortgages in India.

“The new tax adds a direct cost—if an NRI sends $10,000 to India, they will now need to transfer $10,350. That’s a meaningful impact, particularly since this is not currently offset by any tax credit,” said Ritika Nayyar, Partner at Singhania & Co.

“While the revised rate offers some relief, the effective burden remains, especially for Indian migrant workers supporting families back home,” noted S.R. Patnaik, Partner and Head of Taxation at Cyril Amarchand Mangaldas.

Strategic Planning to Mitigate Impact

Financial advisors are already urging NRIs to consider proactive planning before the bill’s proposed implementation date of January 1, 2026.

“NRIs should consider accelerating remittances planned for 2026 into 2025. Consolidating smaller transactions or using financial instruments such as U.S.-based India-focused funds may also help optimize costs,” advised Ankit Jain, Partner at Ved Jain and Associates.

“Establishing offshore investment holding entities, or routing part of the compensation to foreign accounts where legally permissible, may help reduce taxable remittances,” Jain added.

While the bill includes a tax credit provision that may allow lawful residents to offset the excise tax against their U.S. income tax liabilities, experts believe this may have limited practical benefit.

“This credit may reduce the sting for high-income professionals, but for many others—especially those with lower tax liabilities—it will still mean higher out-of-pocket costs,” said Lloyd Pinto, Partner – US Tax, Grant Thornton Bharat.

Ripple Effects for India

Beyond individual remitters, the bill could dent India’s inward remittance flows—an essential source of foreign exchange and household income. Analysts warn that even if the direct tax impact is limited, the psychological effect could reduce transaction frequency or push flows outside formal banking channels.

“Even if exempted on paper, legal ambiguity, fear of audits, and rising compliance burdens may discourage legitimate remitters. That can’t be good for India’s remittance economy,” said Tushar Kumar, Advocate, Supreme Court of India.

Despite the concerns, some remain cautiously optimistic.

“India’s investment opportunities are still strong. While this tax could cause some hesitation, especially in real estate or family transfers, it is unlikely to fully dissuade serious investors,” said Patnaik.

As the bill heads to the Senate, its fate remains uncertain—with internal Republican opposition simmering and Democrats largely skeptical. But for millions of Indians living in the U.S., the countdown to January 2026 has already begun.

A political storm is brewing in Washington over former President Donald Trump’s sweeping new economic proposal—the “One Big Beautiful Bill Act” (OBBBA)—with sharp criticism from within his own party and deep concerns among India’s diaspora over a controversial new 3.5% tax on remittances.