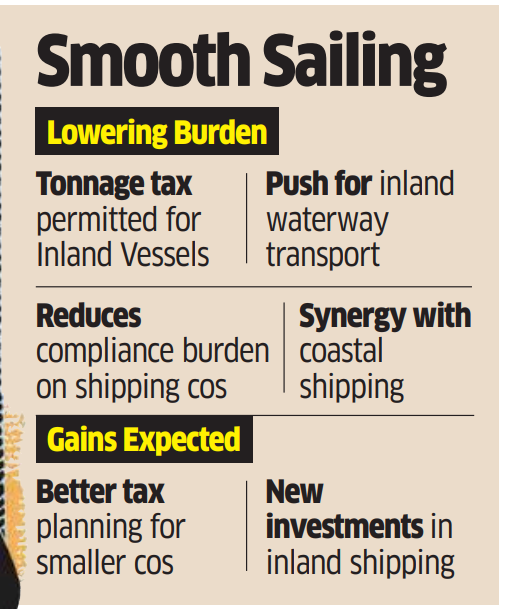

Domestic shipping companies stand to gain from the expansion of tonnage tax scheme proposed in the new Income Tax Bill, 2025. The relaxation has been extended under special provisions relating to income of shipping companies.

Industry experts said the bill, once approved, would help improve cash flow and viability of both inland and coastal shipping operations.

“The bill proposes a major change in Indian tonnage tax law. Inland vessels that were earlier kept out of the ambit of tonnage tax scheme will now get the benefits,” Rakesh Singh, secretary ICC Shipping Association, told ET.

The tonnage tax business will be considered a separate business, distinct from all other activities or business carried on by a company, as per the bill. There will be a 10-year lock-in for the companies opting for the tonnage tax scheme, allowing them an exemption from corporate tax during the applicable period.

The bill proposes to extend the tonnage tax regime to the Indian inland vessels registered under the Inland Vessels Act 2021. Earlier, this regime was restricted to the Indian ships registered under the Merchant Shipping Act, 1958.

“This amendment to the bill is aimed at promoting inland waterways as a mode of transportation by giving the option of tonnage tax to the existing and new Indian shipping companies,” Singh said.

He said that the legislation would lead to new investments in the sector and synergise the businesses of Indian shipping companies owning or operating a combination of ships and inland vessels.

In her budget speech, finance minister Nirmala Sitharaman said the tonnage tax scheme was available to only seagoing ships. “The benefits of the existing tonnage tax scheme are proposed to be extended to inland vessels,” she said.

According to amendments relating to direct taxes in the budget, those opting for tonnage tax need to move an application at least three months before the financial year ends.