The Ministry of Finance (MoF) has released the provisional figures of direct tax collections on April 21 for the financial year 2023-24.

According to the provisional data, the government’s net collections in the financial year 2023-24 are Rs 19.58 trillion, against the budget estimate of Rs 18.23 trillion and revised estimate of Rs 19.45 trillion.

The figures show that while provisional direct tax collections have exceeded the budget estimate by 7.40 percent or Rs 1.35 trillion, it has exceeded the revised estimate by 0.67 percent or Rs 0.13 trillion.

The surge in tax revenue is due to the recent reforms made in the tax system by the government. The government has undertaken reforms in direct taxes to broaden the tax base and reduce the tax burden on taxpayers by establishing an equitable, transparent and fair taxation system to maintain the buoyancy in tax collections.

The result of continuous tax reforms being carried out by the government is visible in the form of continuous robust tax collections. The tax-to-GDP ratio is considered a gauge of the tax revenue that a government collects through taxes relative to the size of a country’s economy. According to revenue secretary Sanjay Malhotra, the tax GDP ratio is expected to reach an all-time high of 11.7 percent in the financial year 2024-25. It is noteworthy that this ratio was 11.6 percent in 2022-23.

Overview of the political landscape of the last two decades

Over the past two decades, India has been ruled by the Congress-led UPA-1 (2004 to 2009) and UPA-2 (2014-2019) and the BJP-led NDA-2 (2009-2014) and NDA-3 (2019 -2024).

The point to be noted here is that while from 2004 to 2014, UPA had a coalition government with the support of some regional parties, since 2014, the NDA is running the government with majority. The tenure of the 17th Lok Sabha is scheduled to end on June 16. Therefore, general elections are being held in India for 18th Lok Sabha.

The results will be declared on 4th June and the next government will take charge by June 16. The main contest in this Lok Sabha election is between the Congress-led Indian National Development Inclusive Alliance (INDIA) and the BJP-led National Democratic Alliance (NDA). It is noteworthy that both Congress and BJP have made reforms in the taxation system of the country.

Therefore, it is expected that whichever political party forms the next government in the 18th Lok Sabha, it will adopt the process of economic reforms along with tax reform. Direct tax collection data for the analysis is taken from the Union Budget website for the period of 2004 to 2023 and ministry of Finance ministry notifications.

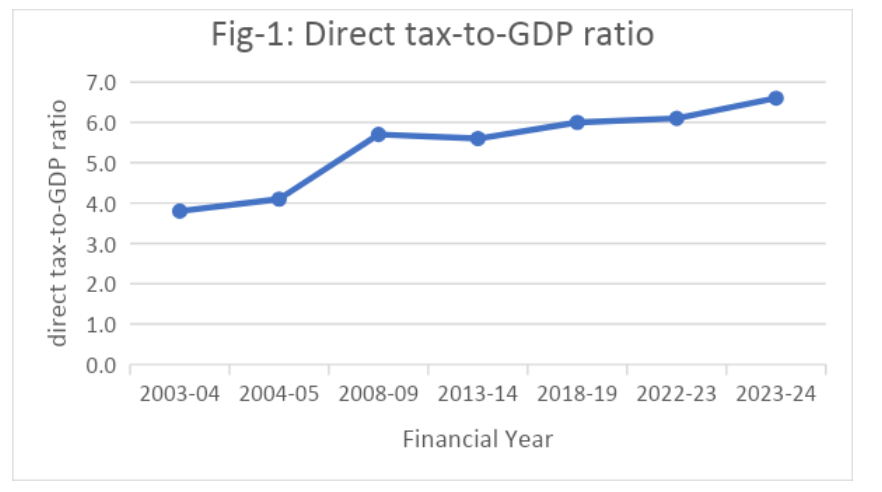

Direct tax-to-GDP ratio

The steady increase in tax-to-GDP ratio is mainly due to the increase in more equitable direct taxes in the recent past. Direct taxes are taxes that are levied on the person or organization that ultimately pays tax to tax authorities of India. The relative growth of direct taxes can be measured through the direct tax-to-GDP ratio. This ratio shows the share of direct taxes in the total monetary value of all final goods and services produced in the country.

The direct tax-to-GDP ratio has shown an increasing trend. It increased from 3.80 percent in 2003-04 to 5.70 percent in 2008-09 and from 5.62 percent in 2013-14 to a 15-year high of 6.11 percent in the financial year 2022-23. This ratio saw an all-time high increase of 6.6 percent in the financial year in 2023-24.

It has increased by 100 bps in the last 10 years since 2013-14, although, if we compare it to other countries, India ranks very low. This ratio is expected to be 6.7 percent in this fiscal year (see Fig-1).

The government’s tax policy is revitalizing the economy by increasing exemptions and rolling back controversial tax demands. These reforms boosted India’s ease of doing business ranking as it provides investors with clarity about the stable tax regime and helps in attracting private investment. Over the past few years, direct tax collections have increased both in absolute and relative terms.

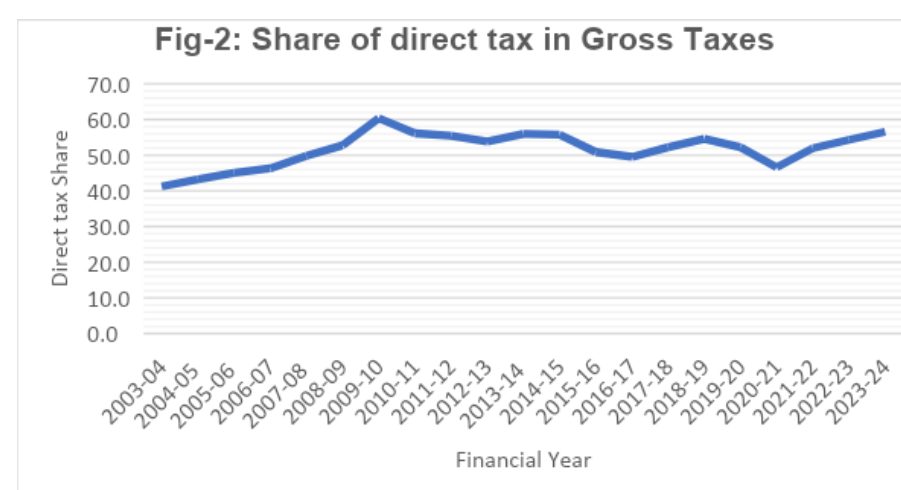

Share of direct taxes in gross tax revenue

The share of direct taxes which enormously comprises corporate tax and personal tax – in the gross tax collection landscape has seen a significant surge over the years. It has gone up from 41.4 percent in 2003-04 to 52.8 percent in 2008-09. In 2013-14, it increased to 56.0 percent.

The share of direct tax in gross tax revenue went down to 54.6 percent in 2018-19 and 52.2 percent in 2019-20.

The share of direct taxes had reached its lowest level in 15 years at 46.6 percent in 2020-21 due to the adverse impact of the global Covid19 pandemic. However, this picked up further to 52.0 percent in 2021-22 and reached the pre-pandemic level of 54.3 percent in 2022-23.

It is expected to be 57 percent in 2023-24. The average share of direct tax in gross tax revenue during 2003-04 to 2013-14 was 51.9 percent, which has increased to 52.5 percent during the financial year 2013-14 to 2023-24. It is expected to be 57.4 percent in the current financial year (see Fig:2).

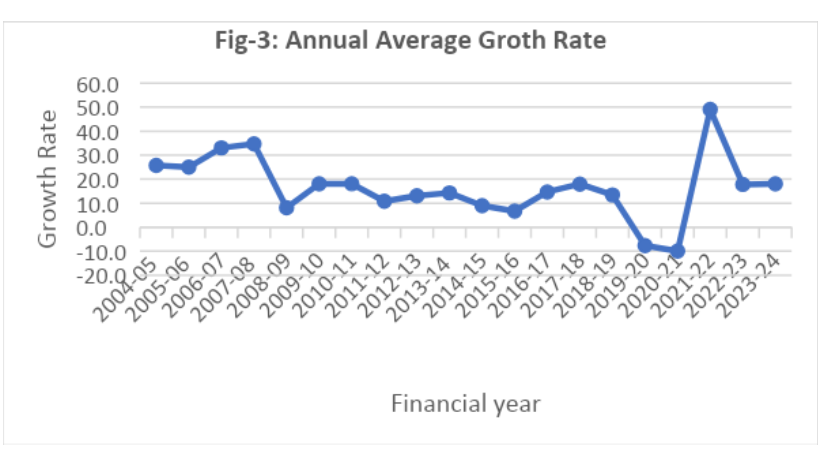

Growth in direct tax collections

There has been a sharp increase in direct tax collections. It has seen a growth of 508 percent from Rs 1.05 trillion in 2003-04 to Rs 6.38 trillion in 2013-14. Subsequently, net direct tax collections witnessed a growth of 207 percent since 2013-14 and reached Rs 19.58 trillion in 2023-24.

In the pre-pandemic year, the growth of direct tax collection fell drastically by 7.7 percent from Rs 11.37 trillion in 2018-19 to Rs 10.49 trillion in 2019-20 and the buoyancy of tax collections had turned negative in terms of the GDP growth. However, the government had rejected media reports of decline in tax collections.

The government was of the view that there is no decline in net direct tax collections, even though it is lower than the tax collections of 2018-19. The fall in collections was due to historic tax reform undertaken and issuance of too many refunds.

The net direct tax collections again fell by 10 percent to Rs 9.45 trillion in 2020-21, mainly due to the impact of the global pandemic. However, in the next year it surpassed pre-pandemic level and achieved a growth of 49 percent. The average growth in direct tax collection has been 20.1 percent during 2004-05 to 2013-14 and 12.9 percent during 2014-15 to 2023-24. The average growth rate of direct tax collections can be seen in Fig-3.

The collections have increased by 17.8 percent from Rs 14.08 trillion in 2021-22 to Rs 16.64 trillion in 2022-23. According to provisional data from the Central Board of Direct taxes, the growth in direct tax collections stood at 18.0 percent in 2023-24, and it is expected to moderate to 13.1 percent in the current fiscal as per budget estimates. The government is hoping to raise Rs 21.99 trillion in the current financial year – which includes Rs 10.43 crore from corporate tax and Rs 11.56 crore from personal tax.

Concluding observations

India is expecting to hit a record high direct tax to GDP ratio of 6.7 percent this year by simplifying and rationalising the tax system.

The buoyant tax revenue is helping the government spend more on infrastructure projects to generate employment and accelerate growth and provide free food grains to the weaker section of the society, as the Prime Minister had announced in a campaign at the time of Chhattisgarh Assembly elections.

Moreover, it is also helping in managing the fiscal deficit target at a time when the performance of divestment of central public sector undertakings is not satisfactory. This is the right time for the government to rewrite the fiscal consolidation target.

(The author is Associate Professor, Institute of Technology & Science, Ghaziabad; Views are personal)