The Reserve Bank of India (RBI) on Friday sharply lowered its inflation projection for the current financial year to 2 per cent, revising it down by 0.6 percentage points from its earlier estimate of 2.6 per cent, after a faster-than-expected decline in food prices pulled headline inflation to an all-time low in October.

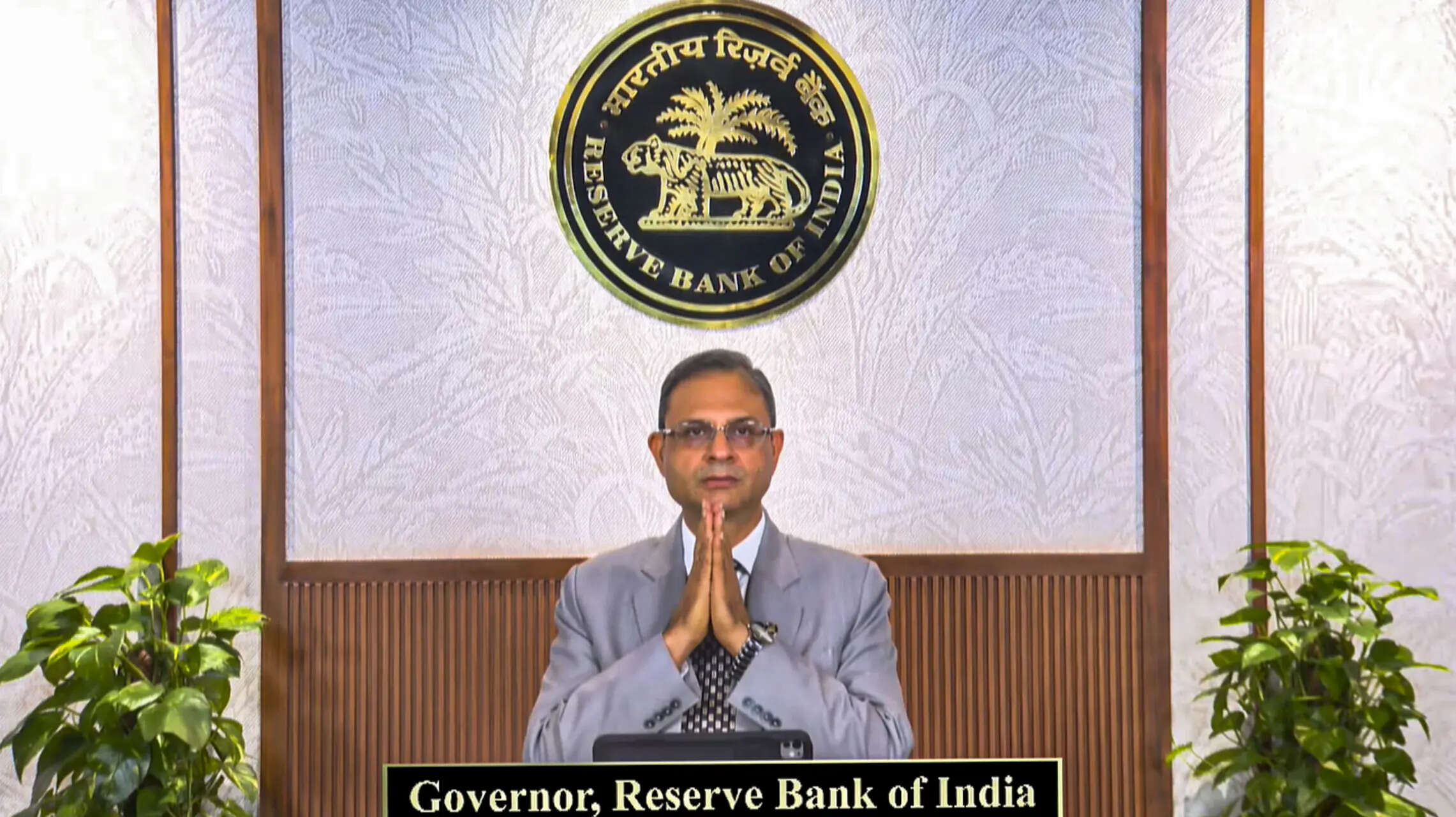

Governor Sanjay Malhotra said headline CPI inflation fell to 0.3 per cent in October 2025, driven by a correction in food prices that defied the typical seasonal pattern seen in September and October. Core CPI remained contained through September and October, despite firming prices of precious metals. Excluding gold, core inflation moderated to 2.6 per cent in October, he added.

Malhotra said the decline in inflation has now “become more generalised,” supported by improved food supply conditions. Higher kharif production, stronger rabi sowing, adequate reservoir levels and favourable soil moisture have improved near-term food availability, while international commodity prices—barring some metals—are expected to moderate.

“Overall, inflation is likely to be softer than what was projected in October, mainly on account of the fall in food prices,” he said.

Based on these developments, the RBI now projects CPI inflation at 2.6 per cent in Q3 and 2.9 per cent in Q4. For the next financial year, inflation is forecast at 3.9 per cent in Q1 and 4 per cent in Q2, with risks assessed as “evenly balanced.”

Malhotra added that underlying price pressures may be even lower than the headline projections suggest because the increase in precious metals prices alone has contributed roughly 50 basis points to measured inflation.

Despite the steep decline in food inflation, the governor said the central bank will continue to monitor supply-side risks and global commodity trends closely, given persistent uncertainties in the external environment.