The National Company Law Tribunal (NCLT) on Wednesday passed an order refraining the Think & Learn subsidiary Aakash Institute from amending the company’s articles of association (AoA) which sought to remove the rights of minority shareholders.

On Tuesday, the minority shareholders of Aakash filed a mismanagement and oppression petition against the current management of the entity.

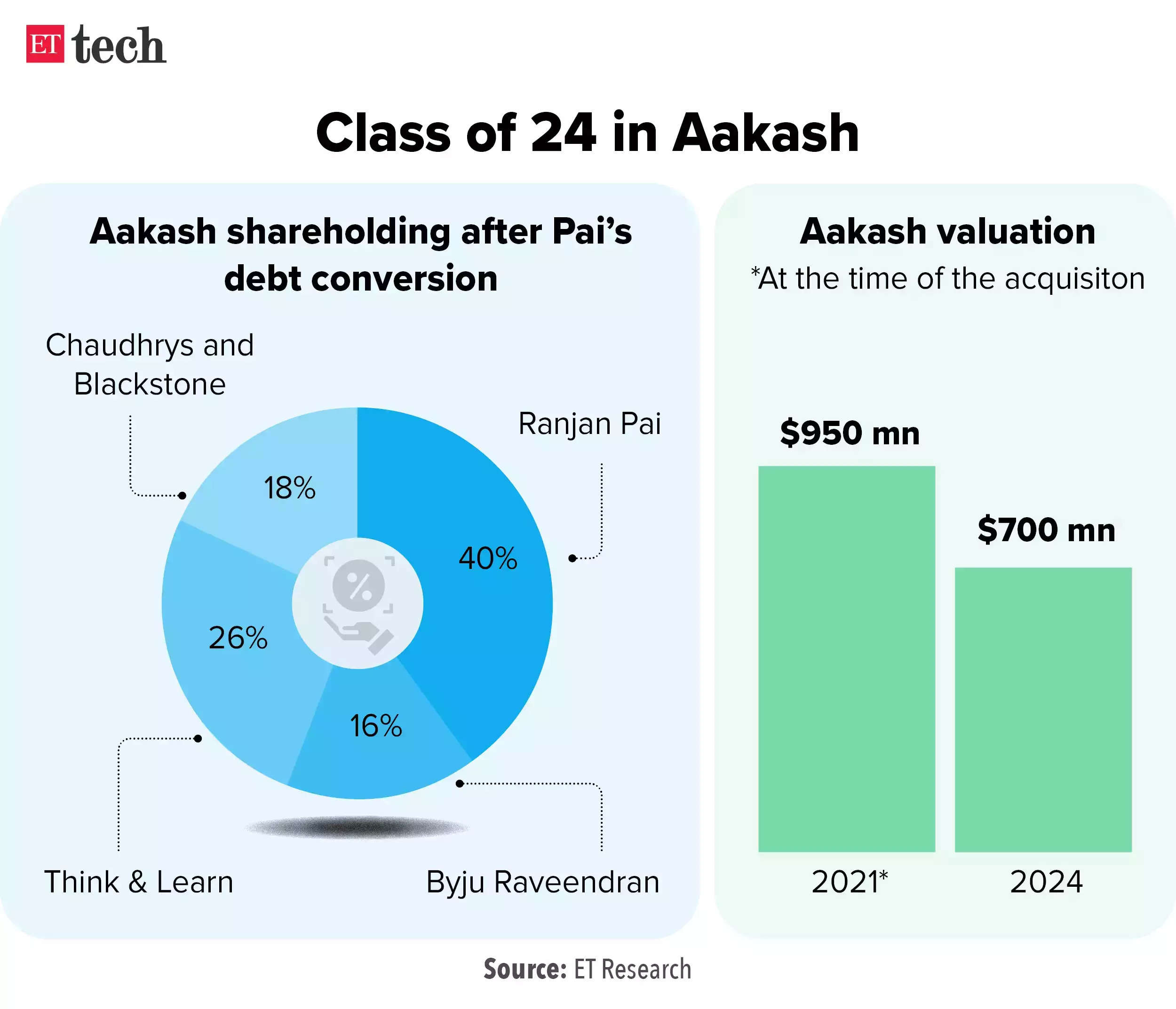

According to the counsel representing the minority shareholders, the extraordinary general meeting (EGM) which was to be held on Wednesday, sought to remove their rights while conferring special rights on the major shareholder Ranjan Pai’s Manipal Education and Medical Group which currently holds about 40% stake in Aakash.

“A 40% shareholder is denying my rights despite my name being in the shareholder register,” said Supreme Court Bar Association president and senior advocate Kapil Sibal who is representing global private investment firm Blackstone. “Their (Manipal) intent is simple. Once they get part B (reserved rights) removed, then they are free to increase the share capital of the company, reducing my 7% to 0%,” Sibal added.

The counsel for Manipal said that the reserved rights flow to minority shareholders from the merger framework agreement (MFA) between Byju’s parent company, Think & Learn, and Aakash.

“The merger has admittedly failed…So there is no merger, therefore the entirety of those rights on reserve matter goes,” Manipal’s counsel said while pointing out that the minority shareholders have tried to suppress the documents.

Countering Manipal’s counsel, Sibal said, that due to confidentiality reasons, shareholders haven’t submitted the document in the court and at the same time raised concerns over Manipal having the document and using it as evidence in the tribunal.

“Relying on a confidential document (the merger framework agreement or the MFA), which cannot be in the hands of Manipal, is an act of oppression against the minority. The fact that the company (Aakash) has released this document is a breach of their own confidentiality agreement,” he added while noting that there’s a collusion between the company and Manipal, to deny him his statutory rights.

“If the MFA is gone, the reserved rights in the MFA are gone. And accordingly, the mirror image in the articles is equally gone. Therefore, there are no rights left,” said senior advocate Mukul Rohatgi who represented Aakash, highlighting that the amendment needs to be made in order to reflect the correct position.

According to Sibal, as long as Blackstone continues to be a shareholder, it will retain its reserved rights irrespective of merger failure. Blackstone and Aakash promotors, the Chaudhrys, together hold 18% of the company.

The minority shareholder, who initially held a 38.5% stake, argued that the MFA and the investor fall-back agreement (IFA) aimed to consolidate Aakash and Think & Learn (T&L) through a merger or share swap.

“The idea was to consolidate the business and get value. Then Think & Learn went into a corporate insolvency resolution process (CIRP), so the merger could not take place, and we repudiated it on the ground that we are not obligated to sell you the shares, and that’s pending before the arbitrator,” Sibal added.

On Tuesday ET reported that Glas Trust, which represents a group of US entities that lent $1.2 billion to Byju’s, questioned the same EGM saying that the meeting may also affect Byju’s insolvency process as the edtech firm will lose control over Aakash.