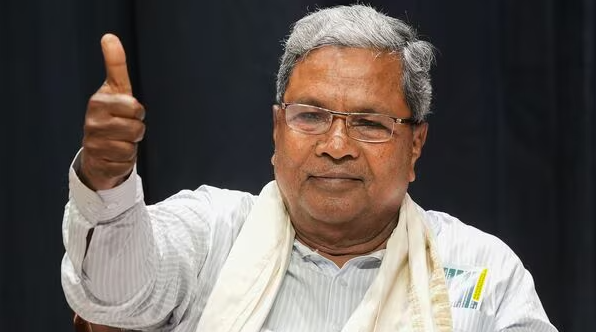

Karnataka chief minister Siddaramaiah on Sunday urged the Centre to increase the cess on items such as cigarettes, pan masala, gutka and luxury cars and use it to compensate the states for the revenue shortfall arising from the proposed cut in goods and services tax (GST) rates, reiterating his earlier demand.

Karnataka is estimated to lose about ₹15,000 crore a year due to the rate changes, the CM told media persons in Mysuru. Revenue minister Krishna Byre Gowda, he said, would highlight the state’s concerns at the GST Council meeting scheduled in Delhi on September 3-4.

Siddaramaiah said that the state welcomed the GST rate cuts but wanted the Centre to compensate states for the consequent revenue shortfall. While Karnataka always suffered financial losses on account of the Centre’s actions, BJP MPs never bothered to raise their voice against the injustice, he said.

Gowda, who represents Karnataka on the GST Council, said the state government was in favour of rate rationalisation with protection against revenue shortfall. States are constitutionally entrusted with the majority of developmental responsibilities, but the majority of revenue sources are with the Union government, he told ET.

The losses to the states are estimated to be 15-20 per cent of their current GST revenues, Gowda said.