Govt. proposes nil tax on income up to ₹12 lakh per annum under new tax regime, Finance Minister Nirmala Sitharaman said in her Union Budget 2025 speech in the Parliament, in New Delhi, on February 1. 2025.. (Representational image only)

With an objective to boost household consumption and aggregate demand, Finance Minister Nirmala Sitharaman announced on Saturday that incomes up to ₹12 lakh would draw no income tax. Effectively, with the existing standard deduction of ₹75,000 in the new tax regime, the limit now stands revised to ₹12.75 lakh.

Watch: Union Budget 2025 | Key tax announcements decoded

With the same objective, the Finance Minister announced a revision in tax slabs, and in order to ease difficulties for the benefit of small taxpayers, she proposed measures for rationalisation of tax deducted at source (TDS) and tax collected at source (TCS) structures.

To boost consumption, savings and investment

Explaining the rationale for the revision in taxation limit, the Minister said the new structure would substantially reduce taxes for the middle class and provide more disposable income, thus helping boost household consumption, savings and investment.

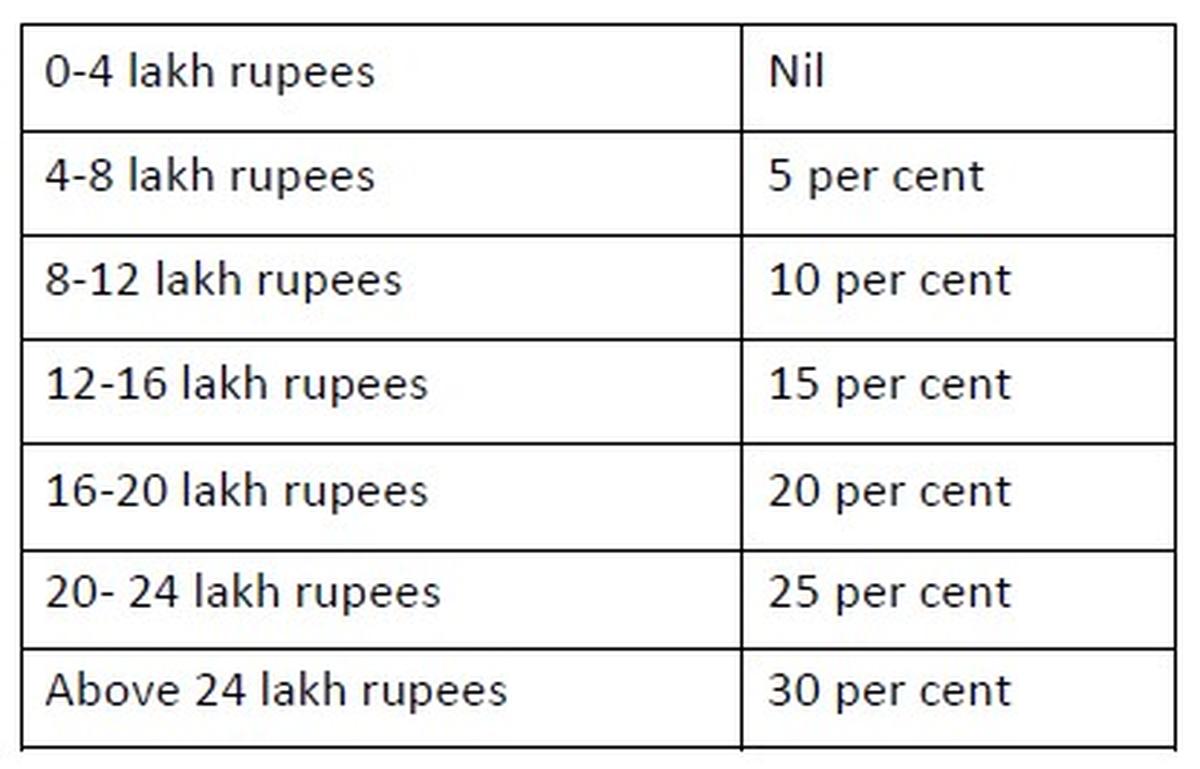

As for the revision in tax rate structures, earnings up to ₹4 lakh would not bear any rate of taxation. The highest slab, that is for incomes exceeding ₹24 lakh, would bear a taxation rate of 30% (refer to the table).

Source: Union Budget 2025-26 document

Also read: Union Budget 2025 updates

Presenting examples, the Minister explained to the house that an income of ₹12 lakh would receive a benefit of ₹80,000 in taxes, that is, 100% of taxes payable at existing rates. Those with an income of ₹18 lakh would receive a benefit of ₹70,000, that is, 30% of tax payable at existing rates.

Akhil Chandna, partner at Grant Thorton Bharat told The Hindu that providing more disposable income to people, would in turn come back to the government when they spend the money.

Furthermore, reflecting on the overall set of changes, Poorva Prakash, partner at Deloitte India, observed that the latest revisions would help boost the attractiveness of the new tax regime from the older tax regime which provided for deductions and exemptions. “This is good in a way, especially from an employer’s perspective, for (with a single tax regime) there is lesser burden about tax administration,” she said.

Fourth revision in Modi-era

Saturday’s revision in income tax limit was the fourth under the Narendra Modi administration. The first of these was undertaken in 2014 (up to ₹2.5 lakh), second in 2019 (up to ₹5 lakh) and third in 2023 (up to ₹7 lakh).

Ms. Sitharaman informed the house that as a result of the proposals announced on Saturday, revenue of about ₹1 lakh crore would be foregone in direct taxes and ₹2,600 crore in indirect taxes.

Rationalisation of TCS, TDS to ease compliance burdens

Ms. Sitharaman proposed to rationalise tax deducted at source (TDS) by reducing the number of rates and thresholds above which TDS is levied. In addition to this, she proposed, threshold amounts for tax deduction be increased for “better clarity and uniformity”.

According to Ms. Prakash, the primary intent about altering rates and thresholds is to manage the volume of transactions under the existing structure. “This, in turn, would help build further compliance,” she said.

Also read: Nirmala Sitharaman’s full speech

About the revisions, the Finance Minister sought the limit for tax deduction on interest for senior citizens be doubled from the present ₹50,000 to ₹1 lakh. Similarly, the present annual limit of ₹2.4 lakh for TDS on rent be increased to ₹6 lakh. “This will reduce the number of transaction liable to TDS, thus benefitting small taxpayers receiving small payments,” she stated.

Furthermore, the threshold to tax collect at source (TCS) on remittances under the central bank’s Liberalised Remittance Scheme (LRS) was proposed to be increased from ₹7 lakh to ₹10 lakh. More importantly, the Finance Minister proposed to remove TCS on remittances for education purposes – which could potentially entail a loan taken from a bank.

Other than this, the Finance Minister also proposed to omit TCS. This was to avert incidence wherein both TDS and TCS were being applied in conjunction to the sale of goods. According to Mr. Chandna, this would be of relief for business-to-business transactions. “Collecting TDS from buyers and TCS from sellers for the same transaction would be averted. This helps ease compliance burden,” he said.

Published – February 01, 2025 12:51 pm IST