MUMBAI: Few comebacks have been as phoenix-like or as fragile as that of Anil Ambani‘s beleaguered business empire. Once weighed down by crushing debt and a string of defaults, two of the group’s core firms, Reliance Power and Reliance Infrastructure, were clawing their way back into investor favour. Both stocks had rallied sharply over the past year, buoyed by signs of operational turnaround and broader optimism in govt’s infrastructure push. But that momentum was jolted on Thursday, when the ED raided group-linked entities, reviving memories of past financial misdemeanours.

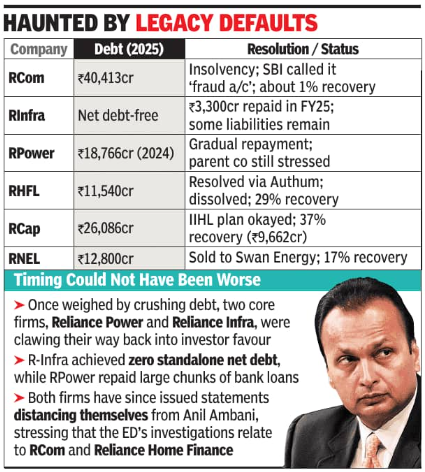

The timing could not have been worse for the Reliance Anil Dhirubhai Ambani Group (RAAG). In July 2025, both Reliance Power and Reliance Infra secured board approval to raise Rs 6,000 crore each via qualified institutional placements and non-convertible debentures, aiming for a total capital infusion of Rs 18,000 crore. This came after aggressive debt trimming. Reliance Infra had achieved zero standalone net debt, while Reliance Power had repaid large chunks of bank loans.

The turnaround had already begun to reflect in financials. Reliance Power swung to a Rs 2,948 crore profit in FY25 from a Rs 2,068 crore loss the year before. Reliance Infra posted a Rs 4938 crore in FY25 reversing earlier losses. Both firms have since issued statements distancing themselves from Anil Ambani, stressing that the ED’s investigations relate to Reliance Communications (RCOM) and Reliance Home Finance (RHFL)-entities no longer associated with the group. Ambani holds no board position in either of the current entities, they said.

At the heart of the current scrutiny are legacy defaults. RCOM, once a telecom major, defaulted in 2017 after its debt surged to Rs 43,000 crore. It entered insolvency proceedings in 2019. Asset erosion and procedural delays led to expected recoveries of just 35%. Reliance Naval soon followed, with lenders forced to take an 83% haircut. RHFL and Reliance Capital were downgraded to default in 2019. That year, the group had become the largest corporate defaulter linked to the Yes Bank crisis, with the failed bank’s exposures nearing Rs 12,000 crore.

The ED is probing quid pro quo allegations between RHFL and Yes Bank, suggesting that entities tied to the bank’s promoters received RHFL funds ahead of loan sanctions. The promoters claim they followed due process and were repaid. A Supreme Court ruling in 2023 cleared its acquisition by Authum Finance, completing its resolution. RCOM and RHFL no longer belong to RAAG. Yes Bank’s largest recovery came from seizing the group’s former headquarters, Reliance Center in Santacruz, which is now Yes Bank’s own office, valued at Rs 1,200 crore and adjusted against Reliance Infra’s Rs 2,892 crore dues. Reliance Capital’s own resolution proceeded under court supervision, with Rs 38,526 crore in claims. The NCLT approved a plan led by Hinduja-backed IndusInd International Holdings in 2024, offering lenders Rs 9,661 crore and Rs 500 crore in cash, implying a 63% haircut.That the remnants of the RAAG group-Reliance Infra and Reliance Power-are mounting a revival, while much of its past remains mired in litigation and write-downs, has not gone unnoticed. The latest enforcement action may test how far the market is willing to separate the new from the old.