Construction and infrastructure firm RKCPL Ltd has filed preliminary papers with capital markets regulator Sebi to raise ₹1,250 crore through an initial public offering (IPO).

The Haryana-based company aims to mobilise ₹700 crore through a fresh issue of equity shares and ₹550 crore through an offer-for-sale, aggregating to a total issue size of ₹1,250 crore, according to the draft red herring prospectus (DRHP) filed on Wednesday.

As part of the offer-for-sale, shareholders Naresh Kumar and Krishan Kumar Goyal will offload shares worth ₹275 crore each.

Proceeds from the fresh issue will be deployed to strengthen the company’s operations and balance sheet.

Of the ₹700 crore fresh issue, about ₹200 crore has been earmarked to meet working capital requirements, while ₹130.02 crore will be used for the purchase of construction equipment.

In addition, ₹50 crore will be utilised for repayment of debt, and ₹138 crore will be invested in subsidiaries – Bathinda Ludhiana Highway Pvt Ltd, Poanta Saheb Highway Pvt Ltd, and Ambala Ring Road Highway Pvt Ltd – to partly or fully repay their borrowings. The balance funds will be used for general corporate purposes.

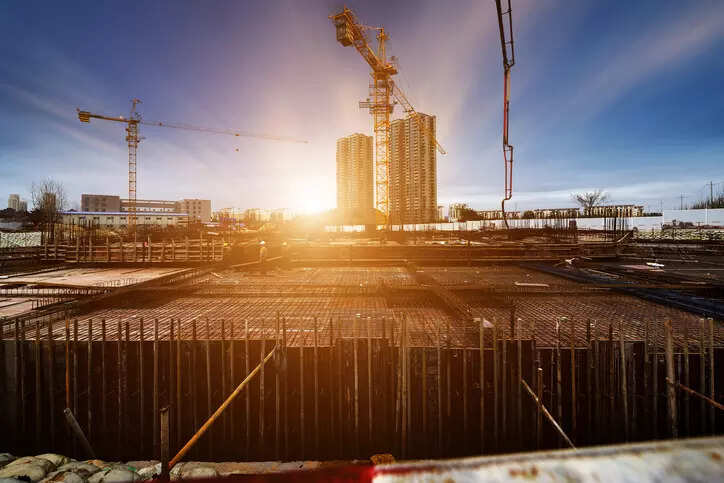

RKCPL is a civil construction and infrastructure development company with experience in executing specialised structural works across India, including elevated roads, flyovers, bridges, road overbridges, highways, expressways, drainage systems, and canal systems.

The company’s business operations are broadly divided into EPC (Engineering, Procurement and Construction) projects and Hybrid Annuity Model projects.

To manage the public issue, RKCPL has appointed Equirus Capital and Anand Rathi Advisors as book-running lead managers.