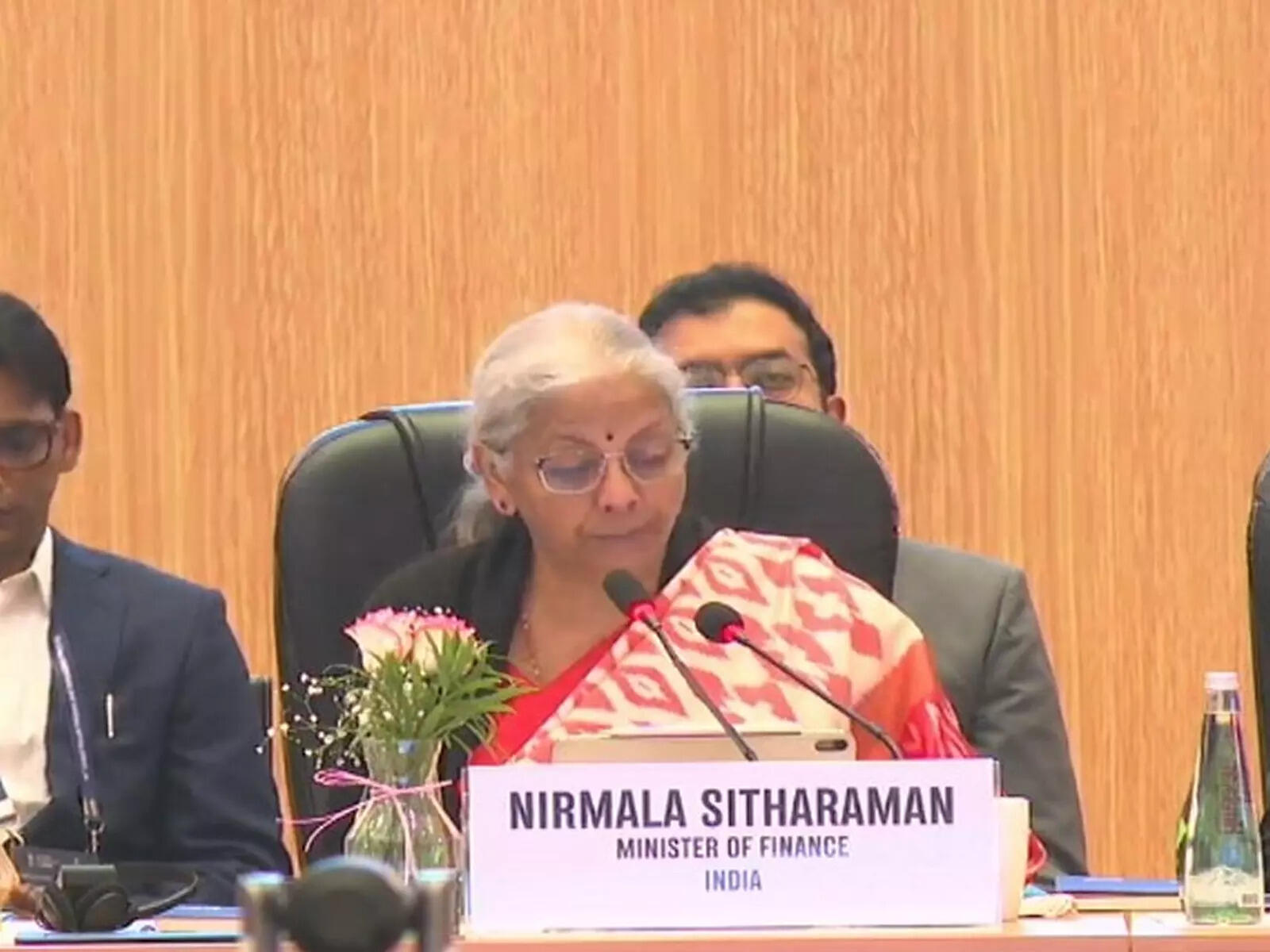

New Delhi: Finance Minister Nirmala Sitharaman on Tuesday said with the growing digitalisation of the economy and emergence of new financial products, countries globally will have to cooperate with timely exchange of information, while ensuring fairness and public trust in the tax system.

Speaking at the 18th Global Forum Plenary meeting, Sitharaman said technological tools like artificial intelligence, along with judgement, should be used to ensure that tax information exchanged among jurisdictions leads to measurable outcomes.

The Global Forum on Transparency and Exchange of Information for Tax Purposes is a multilateral framework comprising 170 jurisdictions. It monitors and peer reviews the implementation of international standards on transparency and information exchange.

Stating that confidentiality and cybersecurity must be maintained with great care, the minister called for joint attention and cooperation to the new challenges arising from the digitalisation of the economy, emergence of new financial products, and evolving structures of beneficial ownership.

“These are not challenges that any one country can address alone. They demand coordination, trust and timely exchange of relevant information,” she said.

The role of the Global Forum in reviewing implementation, developing standards and supporting countries remains critical, she said, adding that transparency can be both effective and fair when it is guided by clear rules, mutual respect and shared objectives.

“As work progresses, our collective task is to deepen current standards where necessary and, to ensure that exchanged information translates into measurable outcomes. The focus must remain on fairness, sustainability and public trust in the integrity of tax systems,” Sitharaman said.

“We may come from different jurisdictions and traditions. But we are united by the shared purpose to ensure that lawful economic activity is encouraged, that evasion is discouraged’¦,” the minister added.

Noting that voluntary compliance has strengthened in India over the last decade due to fairness and predictability in tax systems, the minister said India has been integrating exchanged information with broader analyses of compliance and risk.

She said technology and artificial intelligence offer opportunities to make sense of information in a timely and efficient way, but the key is “judgement, responsibility and a respect for procedure.

“Innovation must always walk hand in hand with accountability. It is that balance which gives systems strength and credibility,” Sitharaman said.