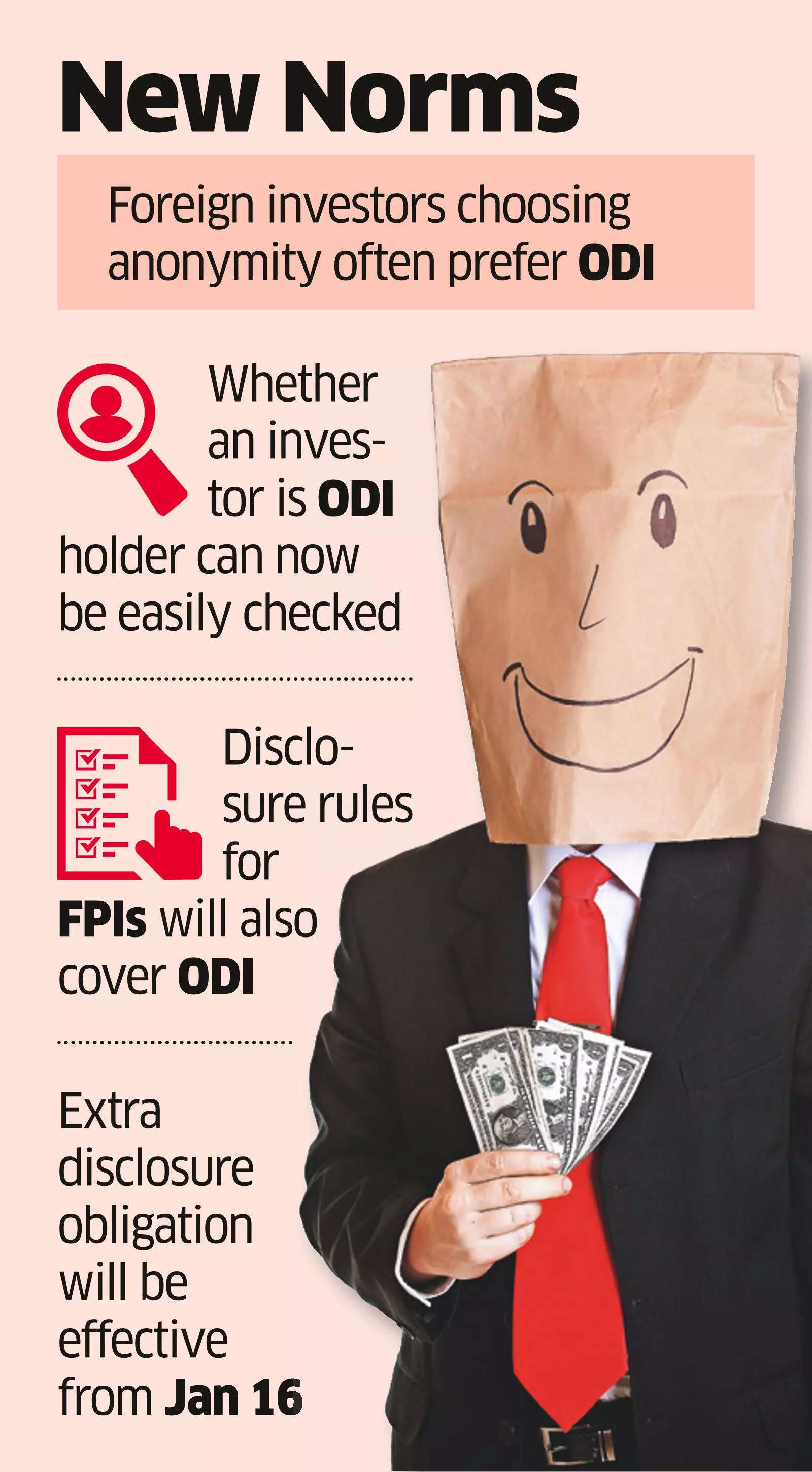

Mumbai: The secrecy over offshore derivative instruments (ODIs), or participatory notes, which have been opaque vehicles for faceless foreign investors trading in Indian stocks, will soon be history.

ODIs are issued by foreign portfolio investors (FPIs) against underlying equity or bonds to overseas investors who bet on Indian securities without registering themselves with the Securities & Exchange Board of India (Sebi). Typically, such investors prefer anonymity or are unwilling to trade directly.

According to a standard operating procedure (SOP) being discussed between Sebi and banks which act as custodians of FPIs, ODIs can only be issued to foreign ODI subscribers who are registered in the portal of NSDL, India’s largest depository.

Currently, FPIs share the names of ODI investors once a month only with Sebi. Once registered with NSDL, one can freely find out whether a foreign investor is a ODI subscriber – just as it’s possible to check if an overseas investor is a Sebi-registered FPI.

An ODI subscriber enlisted with NSDL will have to share its legal entity identifier (LEI) – an alphanumeric code that uniquely identifies a legal entity in financial transactions. The LEI developed after the 2008 meltdown when regulators sensed that inadequate information about counterparties in the over-the-counter derivative market exposed the system to huge hidden risks.

Since issuance of ODIs is an OTC deal between an FPI and a foreign investor, enrolling foreign ODI subscribers with their LEIs would promote transparency on an instrument that was often suspected to have been used for surrogate ownerships in companies. Significantly, the granular disclosures rule triggered for an FPI breaching investment concentration thresholds would be extended to ODI subscribers as well, confirms the draft SOP which was circulated with custodians a fortnight ago.

Under the granular disclosure norms for FPIs introduced by Sebi in 2023 in the wake of the allegations made by the US shortseller Hindenburg against Adani group companies, FPIs must reveal the identities of the last natural persons behind every investor (including ODI holders) in funds with outsized India exposure to equities. The rule kicks in when the exposure of an FPI’s India portfolio crosses Rs 50,000 crore, or has 50% of its India assets under management in stocks of companies belonging to a single corporate group.

EXTRA DISCLOSURE BY ODI HOLDERS The SOP lays down that a similar rule would be applicable for ODI subscribers. An ODI subscriber whose India portfolio has 50% or more AUM in a stock or group would have to share all details to the last natural person(s) even if the FPI issuing the ODIs has not breached the exposure concentration norms.

“The SOP closes the loop on application of granular KYC requirements which have so far been applied to FPIs and now extended to the P-Note route as well. This is in the spirit of the law and ensures the P-Note route is not misused for circumventing the granular disclosure requirements,” said Rajesh H Gandhi, partner at Deloitte India.

An ODI holder using multiple FPIs to buy a stock (or group) would be tracked by the depository and inform the findings to FPIs which issued the ODIs. The FPIs would then ask the ODI subscribers to give details of investors behind the structures. “It is the responsibility of the PNote holder, or ODI subscriber, to inform the P-Note issuer about its grouping information, and also whether the P-Note subscriber itself is registered as an FPI. Logically, the disclosure and clubbing may not extend to ODI issuers in situations where the ODI subscriber invests in units or shares of other FPIs and not through the P Note route,” said Gandhi.

According to Richie Sancheti, founder of the law firm Richie Sancheti Associates, clear responsibilities for ODI Issuers, subscribers, and depositories ensure that all parties are accountable for compliance. “Automated daily reporting and breach notifications allow Sebi and depositories to quickly spot excessive exposures or concentration risks, reducing the chance of market manipulation or systemic risk. Non-compliance would lead to swift consequences, including trading restrictions and forced liquidation,” said Sancheti. For IPOs, ODI positions will be reported on the listing date.

An FPI which breaches the 50% concentration on a single corporate (or group) as on November 17, 2025 (or sometime in December), must bring down the exposure by February 15, 2025. If it continues to breach the rule as on January 30, 2026, it cannot add new positions in the stock (or, group) from January 31 and must realign the portfolio by February 15, 2026. The additional disclosure obligation will be effective from February 16, 2026. A Sebi spokesperson did not comment on the matter till press time