In a biggest revelation, the US Department of Justice (DoJ) and Securities Exchange Commission has indicted Indian billionaire Gautam Adani, Sagar Adani, and six others for their alleged roles in a years-long, multi-million dollar bribery and fraud scam that involved the promise of over $250 million dollar bribes to Indian government officials to secure solar energy contract.

The DOJ alleged the solar energy supply contracts were projected to raise more than $2 billion in profits after tax over an approximately 20-year period. It would have been the biggest clean energy plant ever built. They also alleged that Adani met with Indian government officials to “advance” the “bribery” scheme which took place between 2020 to 2024. As evidence, the authorities have several phone calls between the defendants.

Deputy Assistant Attorney General Lisa Miller stated, “This indictment outlines schemes involving over $250 million in bribes to Indian government officials, fraudulent actions to mislead investors and banks in raising billions of dollars, and efforts to obstruct justice.” She continued, “These alleged crimes were carried out by senior executives and directors to secure and finance large state energy contracts through corruption and fraud, ultimately harming U.S. investors.”

In response, the Adani Group labeled the allegations as “baseless and denied.” A spokesperson for the group emphasized, “The Adani Group has consistently upheld and remains firmly committed to the highest standards of governance, transparency, and regulatory compliance in all regions of its operations. We assure our stakeholders, partners, and employees that we are a law-abiding entity, fully compliant with all laws.”

What is next after being indicted by U.S. authorities?

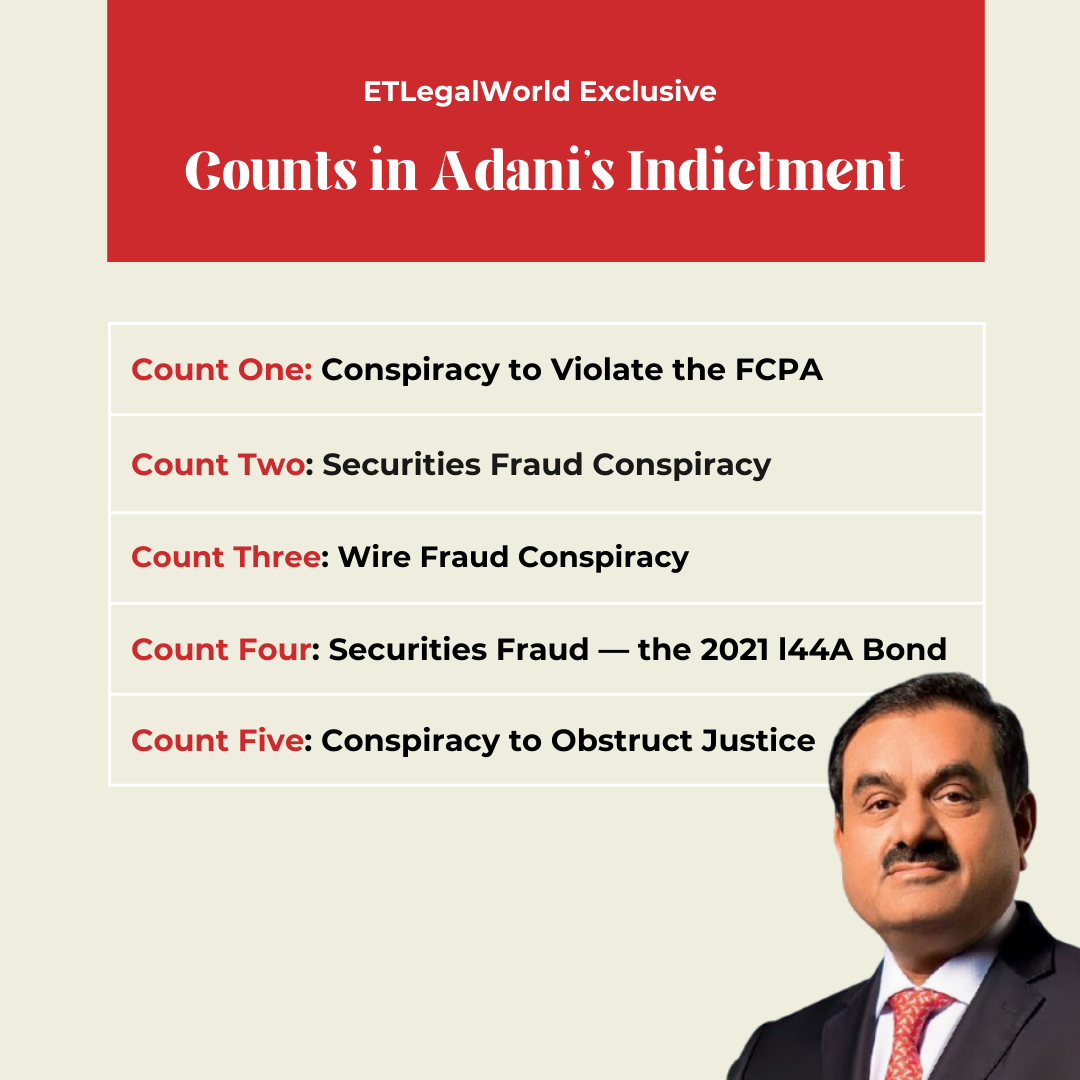

The SEC’s indictment of Gautam Adani and others includes serious charges of securities and wire fraud, as well as violations of the Foreign Corrupt Practices Act (FCPA) and the Foreign Extortion Prevention Act (FEPA). Under U.S. law, particularly in cases involving multiple counts of conspiracy, securities fraud, wire fraud, and obstruction of justice, the legal process can be complex. Typically, the proceedings begin with an indictment, which formally charges the defendants with the alleged crimes.

Due to the severity of the charges and the international scope of the case, as the defendants are not U.S. citizens, extradition procedures will likely be initiated to bring them within U.S. jurisdiction. Once arrested, the defendants will be required to appear before a magistrate judge, who will inform them of the charges and set conditions for their release, potentially including bail. It’s important to note that the indictment is only an accusation, and the defendants are presumed innocent until proven guilty in court.

Two parallel legal proceedings appear to be underway in the U.S. against Adani Green Energy. The first involves criminal charges, while the second is a civil complaint filed by the SEC (the U.S. equivalent of SEBI), alleging misrepresentation. According to the SEC, Adani Green misrepresented in its investor documents that it had a robust anti-bribery compliance program, knowing this statement to be false, as it was allegedly involved in bribery schemes to secure government contracts.

Karishma Vora, a barrister at 39 Essex Chambers, identifies three key aspects of the case. She notes that, unlike most misrepresentation cases where the false statement is typically oral, the SEC’s case appears to be bolstered by the fact that the misrepresentation was made in writing in Adani Green’s offer documents, which sought to raise hundreds of millions.

Vora adds, “It will be interesting to see whether evidence from the criminal proceedings, particularly regarding the bribery, can be used in the civil proceedings. When criminal agencies initiate proceedings in parallel with civil proceedings, it becomes more challenging for the defendant”.

She further explains that for the SEC to succeed in its misrepresentation claim, it must prove that the statements in Adani Green’s offer documents were false. If the statements were knowingly false, it would constitute fraudulent misrepresentation. If the statement maker was unaware of the falsity at the time, it would be negligent misrepresentation. Additionally, in the civil proceedings the SEC must show that investors relied on the misrepresentation and suffered losses.

Since Adani Green has withdrawn its bond offering, which was initially intended to raise over $600 million, the third requirement—the investors suffering losses—may not apply to the raised amount.

Can a US court prosecute Indian citizen Gautam Adani?

India and the US have an Extradition Treaty established in 1999, which, under Article 2, stipulates that an offense is extraditable if it is punishable by a prison sentence of more than one year or a more severe penalty in both contracting countries. This “dual criminality” clause ensures that alleged crimes such as conspiracy, securities fraud, and wire fraud meet the criteria for extradition.

As a result, US authorities can request the extradition of individuals from India, provided that the offenses are also punishable under Indian law. “Since offenses like conspiracy, bribery, securities fraud, and wire fraud are punishable under Indian law, with specific laws addressing each offense—such as the Bharatiya Nyaya Sanhita, 2023 (which addresses conspiracy), the Prevention of Corruption Act, 1988 (which deals with bribing public officials), and various provisions under the SEBI Act, 1992 and SEBI Regulations (2003) (covering securities fraud)—it is clear that these offenses align with Indian legal provisions,” says Kunal Sharma, Partner at Singhania & Co.

Although India does not have a specific statute for “wire fraud,” similar offenses are covered under the Information Technology Act, 2000, which addresses cheating by impersonation through computer systems, a provision similar to wire fraud.

“Therefore, it is reasonable to conclude that, provided all the legal requirements of the Extradition Treaty are met, defendants, including Gautam Adani, could be extradited to the US for prosecution,” Sharma adds.

Can the Indian government investigate this case?

Sharma states that India’s legal and regulatory framework is well-equipped to handle such matters, especially in cases involving potential legal violations, regulatory breaches, or issues of public significance.

India’s legal system offers strong mechanisms for addressing such concerns. Regulatory bodies like the Securities and Exchange Board of India (SEBI), the Ministry of Corporate Affairs (MCA), and other agencies have the authority to investigate and take appropriate action against individuals or entities engaged in fraudulent activities, even if they have international implications.

Under the Companies Act, 2013, the MCA has the power to initiate investigations into corporate fraud and mismanagement. SEBI, under the SEBI Act, 1992, is authorized to probe securities fraud and insider trading. The Prevention of Corruption Act, 1988, and the Foreign Exchange Management Act (FEMA), 1999, also provide legal frameworks for investigating corruption and foreign exchange violations, respectively.

Additionally, the Indian government can collaborate with U.S. authorities through international agreements like the Mutual Legal Assistance Treaty (MLAT), enabling the exchange of information and evidence. Such cooperation would enhance the effectiveness of Indian investigations.

“Given the high-profile nature of this case and its potential impact on investor confidence and market integrity, it is in the public interest for the Indian government to prioritize an investigation. Judicial oversight will help ensure that the investigation is conducted fairly and transparently, preserving the rule of law,” says Sharma.

Impact on Adani Group’s Business

The Adani Group finds itself under renewed scrutiny over accusations of financial misconduct and regulatory breaches. In January 2023, Hindenburg Research accused the conglomerate of stock manipulation and accounting fraud, causing a significant drop in its market value. In response, SEBI initiated an investigation into these allegations.

SEBI’s investigation reportedly uncovered violations by the Adani Group, including breaches of disclosure rules and offshore fund holdings. SEBI has previously taken action against companies for fraudulent financial misstatements, labeling them as misrepresentation and unfair trade practices under Regulation 4(2) of the SEBI PFUTP Regulations, 2003.

“The Supreme Court of India directed SEBI to submit a report on the Adani investigation within a specific timeframe. Failure to comply would be considered contempt of court and reflect poorly on the regulator’s efficiency. These actions are likely to cause a downturn and impact the stock,” said Alay Razvi, Managing Partner at Accord Juris.

While the earlier Hindenburg report primarily highlighted governance issues and financial irregularities, the new allegations appear more serious and potentially more damaging. Experts suggest this could erode investor confidence, particularly among foreign institutional investors, leading to increased market volatility.

“Both domestic and international regulatory and legal scrutiny may intensify, potentially delaying projects, increasing borrowing costs, and affecting business operations. While Adani weathered the Hindenburg storm, the current situation may not be as forgiving. The Supreme Court’s relatively lenient stance previously cannot guarantee a similar outcome, especially if concrete evidence emerges this time,” said Ketan Mukhija, Senior Partner at Burgeon Law.