The US DoJ’s indictment paper said Adani Group had misled investors by giving false statements to Indian stock exchanges – NSE & BSE. Under Sebi’s rules for listing and disclosures of corporate events, there are various kinds of penalties for violations of such rules (named Listing Obligation & Disclosure Requirements, or LODR).

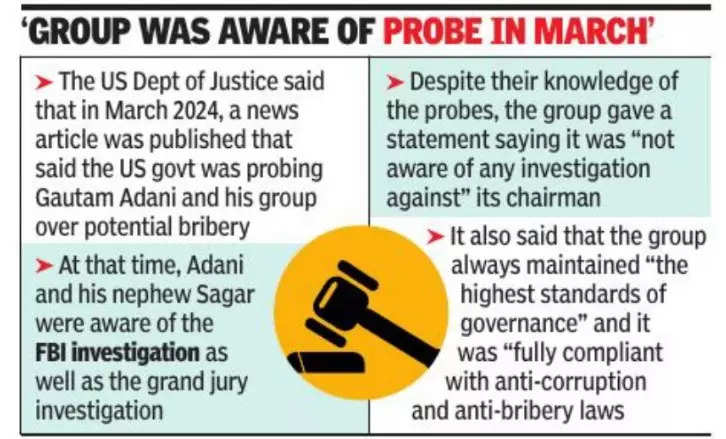

In its indictment paper, the US DoJ said that in March 2024, a news article was published that said the US govt was probing Gautam Adani and his group over potential bribery. At that time, Gautam Adani and his nephew Sagar Adani were aware of the FBI investigation as well as the grand jury investigation. This was after a subpoena was issued to the group’s top executives. The US investigators also had the right to search electronic devices of Sagar Adani that allowed them seizure of evidence of criminality by Gautam Adani and others, the US DoJ paper said.

Despite their knowledge of the US govt investigations, the group gave a statement to the news article saying it was “not aware of any investigation against” its chairman Gautam Adani. In the same article, it also said that the group always maintained “the highest standards of governance” and it was “fully compliant with anti-corruption and anti-bribery laws in India and other countries,” the DoJ paper noted.

On March 19, 2024, the group also falsely informed NSE and BSE that Adani Green Energy had not received any notice from the (US DoJ) in respect of the allegations referred to in the news article earlier that month.

The DoJ indictment alleged that Gautam Adani and Sagar Adani had forced people at the group “to make false and misleading statements” about the US govt’s investigations against Adani Green Energy.

On Thursday, the Adani Group denied all allegations in the indictment paper. The bourses asked for clarification from Adani Group companies after several news reports said that the US DoJ and SEC were investigating the group’s top executives and stocks crashed.

The two stock exchanges, NSE and BSE, didn’t reply to TOI’s query on whether they had taken any step relating to US govt’s allegation of misleading and false disclosures by the Adani Group. Under the LORD rules, a monetary penalty could be imposed on a company for such violations. The rules also allow for freezing of promoters’ shareholding, restriction or total suspension of the stock from trading on exchanges or complete delisting.