The Insolvency Bankruptcy Board of India has proposed that operational creditors can exercise the option of mediation before filing insolvency applications under Section 9 of the IBC.

Under this scheme, the operational creditor can undergo mediation with the aid of a mediator, as provided under the Mediation Act, 2023.

In case of failure of mediation settlement, the mediator will prepare a non-settlement report which shall be annexed with the application for initiation of the Corporate Insolvency Resolution Process before the adjudicating authority.

This proposal aims to reduce the burden on the adjudicating authority through expediting admissions.

| Several recurring issues in Section 9 applications, particularly disputes between Operational Creditors and Corporate Debtor |

| Disagreements on Goods/Services regarding the quality or performance of goods and services provided |

| Contractual Disputes having allegations of non-compliance with contractual terms by either party |

| Discrepancies over the exact amount owed or alleged underpayment |

| Claims of the CDs against the OC for set-offs or damages |

These issues aforesaid are time-consuming and eventually unnecessarily burden the limited judicial capacity.

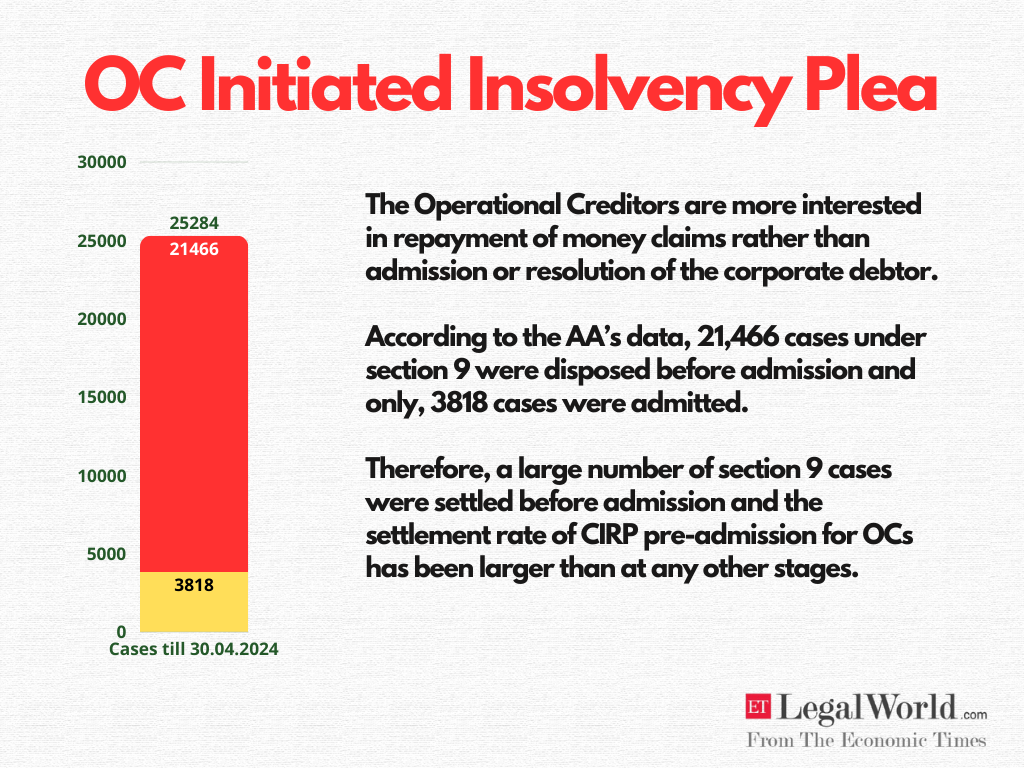

The adjudicating authority must conduct hearings before accepting or rejecting an application, making the process time-consuming. Thus, to resolve disputes between the OC and corporate debtor at the earliest stage, and facilitate faster admission by AA, IBBI has proposed mediation as an option that may be considered as an effective tool. “IBBI has proposed that an OC can exercise the option of meditation and in case meditation fails, the mediator shall share a settlement report that can be filed with the NCLT setting out all the details of the claim, which will aid the NCLT with the facts and cut down on time for final orders,” Saloni Kothari, Group General Counsel, BDO India explains.

If effectuated, this will be a fantastic move for faster, more effective, and efficient settlement for aggrieved operational creditors who currently have to approach the NCLT as a last resort due to the construct of the law, knowing that their money claims may not be settled in the insolvency process, instead, the process may come at a cost.Saloni Kothari, Group General Counsel, BDO India

Further comments on the proposals are invited by November 24, 2024.